Introducing the Eight Octo Capital Private Credit Fund

Secure, income-focused returns through real estate-backed investments.

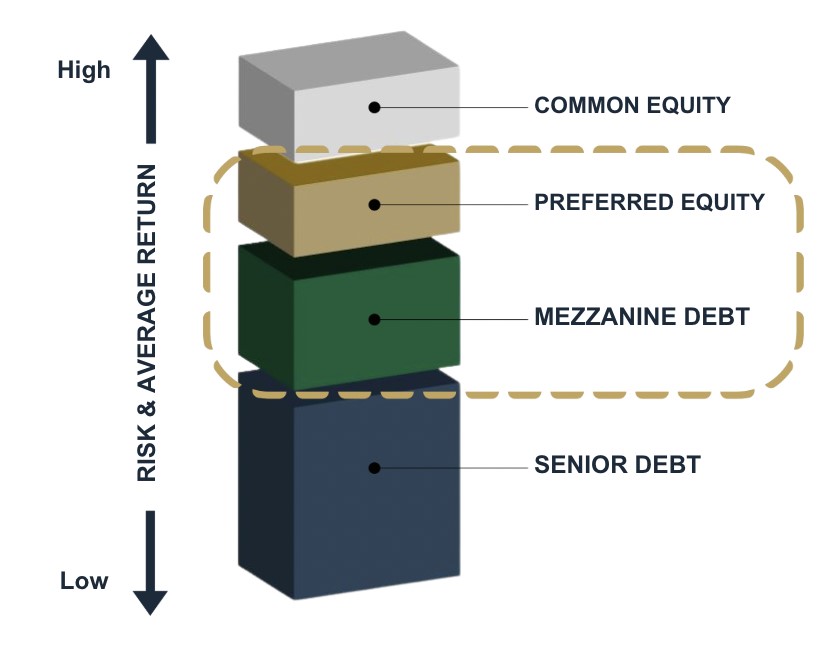

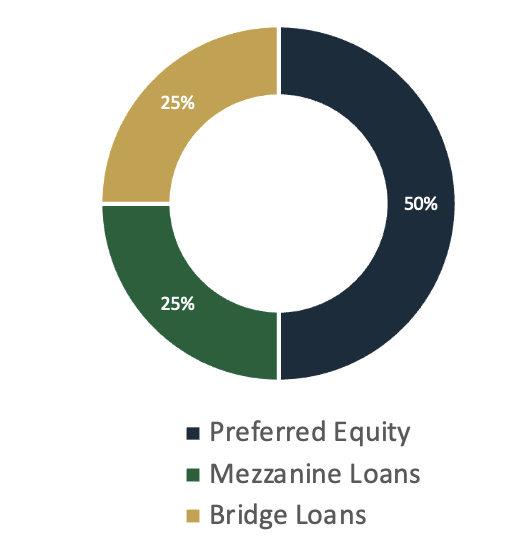

A shift in lending practices has created opportunities to provide credit to commercial real estate. Partnering with Aspen Funds, our fund invests in preferred equity, mezzanine debt, and bridge loans, delivering current yield, profit sharing, and secure, preferred positions for consistent, passive cash flow.

Now Accepting Investments

The Eight Octo Private Credit Fund is open to accredited investors.

Click the Soft Commit button below to express interest.

Missed the Live Webinar? Watch the recording below to learn more.